Despite a slow and contradictory labor market, it's strong and moving toward pre-pandemic levels. Daniel Culbertson, Senior Economist at Indeed Hiring Lab, told the audience at the annual RPOA Conference in September 2023 that the labor market has slowed to adjust to the two years of post-pandemic highs. During those two years, employers tried simultaneously hiring talent as the economy was mending itself. The hiring action of the employers put a jolt in the labor market, and now it's slowly adjusting to pre-pandemic employment levels.

To give his audience a good overview of the labor market, Culbertson discussed labor supply and demand, wages, remote work, labor data talent leaders should watch, and recruiting in the current labor market. Below is a recap of his presentation.

Culbertson explains the common thread running through the trends in the labor market at the time of his presentation.

Labor Supply and Demand

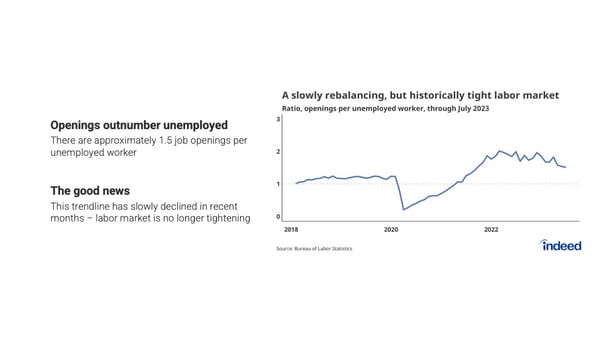

From a supply and demand standpoint, Culbertson shared that employers have slowed their hiring, but the situation is improving. According to the Bureau of Labor Statistics (BLS), the rate of job openings per unemployed worker hit an all-time high of two early last year. That means there were two job openings for every unemployed worker. However, things have improved a little bit since then. There are now about 1.5 job openings per Unemployed Worker. Although that's an improvement, Culbertson said, "We're still very far out of balance compared to where we were pre-pandemic, which was a strong labor market with a lot of hiring going on."

Labor Demand Side

When discussing the demand side of the labor market, Culbertson shared with the audience that job postings on Indeed decreased by 40 percent at the onset of the pandemic. However, the site saw job postings during the pandemic recovery increase because employers were hiring talent simultaneously. He said that activity peaked in late 2021. Since then, the labor market has slowed, and job postings on Indeed are down 14 percent from last year. Despite this cooling-off period, Indeed has 30 percent more job postings than pre-pandemic.

Indeed focuses on the job postings of temp workers or staffing employment because job postings for these workers are a little more responsive to economic shifts. "Staffing employment tends to decline before the overall labor market declines, he said, "But it tends to bounce back ahead of economic improvements." BLS data shows staffing employment or temporary help services fell in the past months. Typically, this behavior raises eyebrows because declining staffing employment data could signal a recession. However, he said there are probably some non-recessionary reasons for its decline. For example, employers might have hired full-time workers instead of temp workers because they have confidence in the economy's strength.

Labor Supply Side

On the supply side of the labor market, Culbertson shared that it has improved, but he warned the audience it's uncertain it'll continue to improve. He observed that it needs to be clarified whether the labor supply will keep improving because of demographic factors. A sign of improvement is that last year, people started participating in the workforce and continue to do so in a big way. According to BLS data, the labor participation rate, the number of people working or looking for work, has increased consistently over the past year, surpassing its pre-pandemic baseline. The number of prime-age workers, aged 25 to 54, active in the labor force is the same as pre-pandemic and continues to improve.

However, the participation rates among younger workers aged 16 to 24 and workers older than 54. have recovered to where they were pre-pandemic. Baby Boomers, a large labor force segment, retired rapidly during the pandemic and continue to retire.

Other demographic factors affecting the labor supply are slowed immigration and decreases in population growth. Immigration paused during the pandemic. Although foreign-born workers are returning, the labor market needs more workers. Also, slowed global population growth is affecting improvements in the labor supply as well. He said that the United States recently hit a 100-year low in the birth rate. He warned that low birth rates don't bode well for the future of the labor supply.

Wages and Salaries

Indeed's employer data shows that wage growth peaked then came down to earth, and more and more employers are including wages and salary in their job postings.

Wage Growth

There was a lot of upward pressure on wages because of high worker demand and low supply. As a result, employers pushed wages up significantly in early 2022. Job postings on Indeed showed that wage growth peaked at about 9 percent year over year. But it has fallen back down because demand is weakening, supply is improving, and the post-pandemic hiring frenzy ended. Empoyer data shows wage growth slowing down to about 4.5 percent as of August.

However, wages still are showing robust growth; 4.5 percent wage growth is still well above where it was pre-pandemic. Culbertson noted that wage growth depends on the job category. Wage growth is at 4.5 percent for some job categories, above 4.5 percent in other categories, and in some types, wage growth has vanished.

Salary Transparency

When attracting talent, salary transparency is becoming a common and important practice for employers. Culbertson said that Indeed saw an increase in employers providing information about wages and salaries in the job postings. Its most recent research shows that 50 percent of the job postings on the site listed a wage or salary right inside the job posting. Interestingly, many states and metro areas have passed legislation requiring salary transparency; however, in areas of the United States that don't have any legislation requiring salary transparency, the practice of salary transparency is growing.

Remote Work

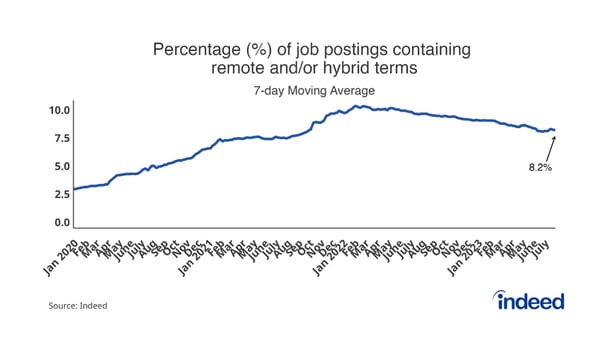

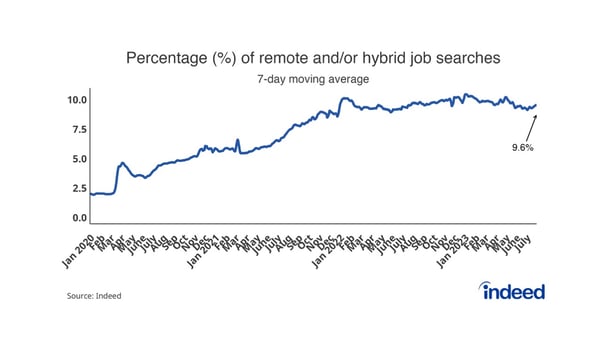

Remote work is in a state of contradiction. On the one hand, remote work opportunities have decreased over the past year because, as Culbertson surmises, employers and workers are figuring out if remote work is best for them. He also observed that the reduction in tech jobs, which are traditionally remote, contributed to the decrease in openings for remote work. On the other hand, the number of postings for remote work on the Indeed site is still at an all-time high, and job seekers are still looking for remote work opportunities.

Indeed's data shows that at the time of Culbertson's presentation, the percentage of job postings on its site using "remote work" or "hybrid" decreased from its peak in 2022, yet the use of those terms remains three times higher than their usage in 2020. And its data also shows job seekers continue looking for remote work at a higher rate in 2023 than in 2020.

Labor Market Data To Watch

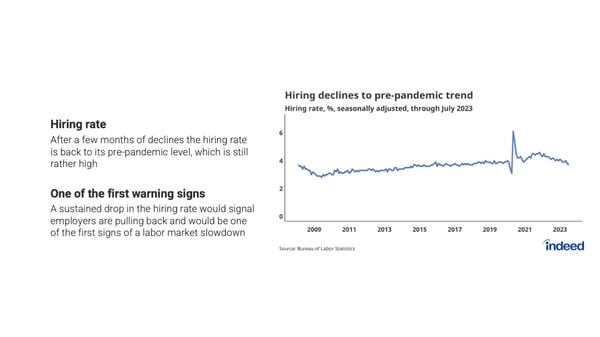

Culbertson shared that talent leaders should always watch the data on hires, quits, and layoffs. He noted that BLS publishes these labor statistics two months after gathering them. For example, during his presentation in September, he used the latest data from BLS, which was from July.

He said that paying attention to hiring data is essential because one of the things employers do during any economic disturbance is decrease their hiring. He noted that the number of hires has slowed over the past year, but it's not a cause for alarm. It's not a cause for alarm because hiring has slowed, but as of July, the number of hires is at the level it was at pre-pandemic. Alarm bells would sound if the level of hires fell below pre-pandemic levels. Therefore, despite the slowdown in hiring, employers are still hiring many workers.

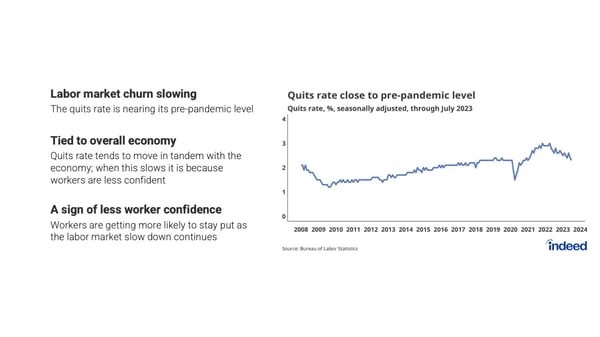

When discussing the quit data, he shared some good news: the "great resignation" is in the rearview mirror. The quit rate among workers, not accounting for retirements, has decreased over the past year. And it’s at the same level as it was pre-pandemic. The data shows that churn still exists, but it's falling from its peak in 2022.

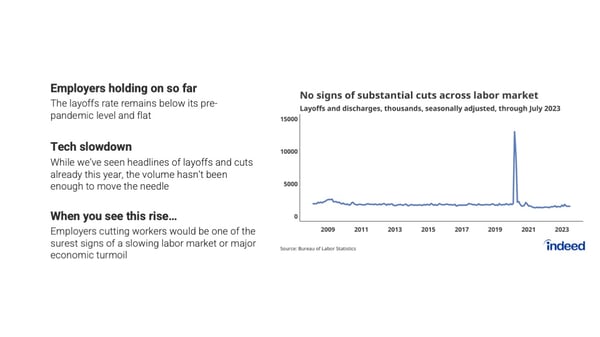

Despite the concentrated layoffs in the tech industry, layoffs across the labor market are relatively flat, Culbertson said. He also pointed out that layoffs are still below pre-pandemic levels. Therefore, there's no cause for alarm with the layoffs data, but talent leaders need to keep an eye on this data, for if it starts to rise, the labor market will change.

Recruiting In The Current Labor Market

Culbertson told the audience that the economic data shows a healthy economy; growth has been positive over the past three quarters. But he warned that there's always a chance of a recession happening. Most economists have downgraded their predictions of a recession next year, but he added that those predictions and any predictions they make should be taken with a grain of salt.

From an economist's point of view, the labor market is still out of balance: labor supply is outstripping demand. Talent leaders need to continue current recruiting practices for a tight labor market. The key takeaways he said to focus on moving forward include:

-

Pay and pay transparency: Wage growth is likely to slow, but barring any dramatic changes in labor market dynamics, competitive pay will remain key

-

Deepen talent pools by any means necessary: Job training – draw from other industries and bring workers up to speed. Do not screen out candidates with gaps in resumes or job-hoppers. Fair-chance hiring – loosen rules on background checks.

-

Remote work and flexibility: When remote isn’t an option. Flexibility is more important to job seekers than ever, especially childcare support.

Conclusion

From Indeed’s Senior Economist Culbertson's presentation, you can see that the slow and contrary labor market is slowly progressing towards pre-pandemic employment levels. While the labor market continues to adjust, recruiters and talent leaders should watch hiring, quitting, and layoff data from the BLS to adapt to any abrupt change in the market. Best current recruiting practices include competitive pay, deepening talent pools, and offering remote work and flexibility.

We encourage you to watch Culbertson's full presentation on demand at our 2023 RPOA Conference page to further your understanding of these dynamics. Whether you're a seasoned talent acquisitions leader or new to hiring, key learnings can help inform and shape your strategies moving forward.

-min.jpg)