Recruitment process outsourcing (RPO) experienced some of the most volatile market conditions that tested and proved its resilience and validity during the Covid-19 pandemic of 2020. Everest Group is one of the leading organizations researching and reporting on current market trends for RPO. Everest Group is a strategic partner of the Recruitment Process Outsourcing Association.

In a recent collaboration between the two organizations, Ani Kulkarni, Everest Group analyst and co-author of the RPO PEAK Matrix shared the following insights on the global RPO landscape.

The current global RPO market

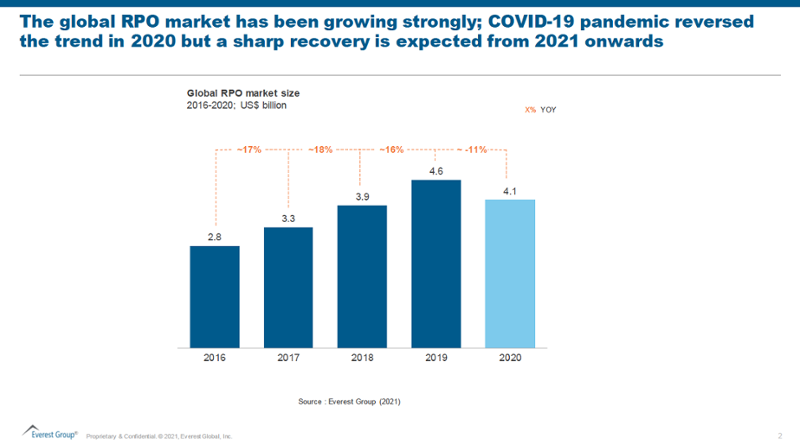

"If we were to look at the industry as a whole, the Global RPO market has been doing tremendously well over the last five or six years enjoying strong double-digit growth," said Kulkarni.

The RPO market declined during 2020 because of the coronavirus pandemic and its negative impact on RPO providers. "We saw that in Q2 and Q3 2020, there were major hiccups along the way. A lot of organizations stopped hiring completely. And because of that, a lot of service providers suffered,” said Kulkarni. “We saw a complete stop or major drop in permanent hiring resulting in an RPO market decline of close to 11%.”

On a positive note, Everest Group research points to positive signs in the market. "We have seen from Q4 2020, and we continue to see this year as well, that the recovery has well and truly started again," Kulkarni emphasized. Of course, the recovery will hit the different RPO markets at different time periods. "The timing of recovery will be different for different global markets because we are at different stages of the second and third global Covid waves. As critical economies recover and as organizations move into a post-pandemic world, the RPO industry as a whole is well-positioned to benefit.

“We anticipate that 2021 will be the year of recovery where we'll probably reach the levels, which we saw back in 2019, as well as for the next three to four years,” said Kulkarni. “We anticipate strong double-digit growth again as we've seen before the pandemic," Kulkarni added.

Global RPO market-specific trends and expectations

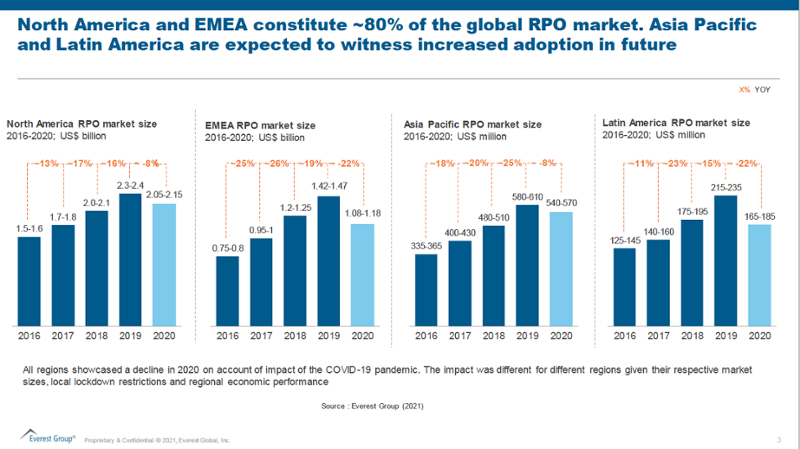

Everest breaks down the global RPO market into four major regions: North America; Europe, Middle East, and Africa (EMEA); Asia Pacific (APAC); and Latin America (LATAM). "Each global market has its specific nuance, market trends and specific set of service providers," Kulkarni said.

"The North American RPO market is the biggest market in the global context," he noted. It contributes to almost 50% of the size of the whole industry. Everest research showed that the North American RPO market had an 8 percent decline during Covid in 2020.

EMEA is the second-largest global market after North America. "Together [North America and EMEA] comprise almost 80 percent of the RPO market," Kulkarni added.

The APAC and LATAM markets are growing in importance and their market sizes are increasing. Kulkarni said that these two markets are seeing higher growth rates compared to the more mature markets of North America and EMEA.

Everest is anticipating over the next few years, these [APAC and LATAM] markets will continue to see major growth and their market share will continue to improve as RPO gains rapid acceptance in countries like China, India, and Brazil.

As stated above, the pandemic caused a decline in all RPO regions. However, Kulkarni explained that each market was affected differently because “of size, the nature of the industries, and the local differences between how the COVID 19 pandemic played in each market, as well as the restrictions around lockdowns."

Despite the pandemic’s impact, Kulkarni expects "a strong recovery in 2021 for all these markets.” They’re all expected to move back to the 2019 numbers.

No perceptible drop in the Asia Pacific market

"The APAC region as a whole was less impacted from the Pandemic’s first and second outbreaks in 2020," Kulkarni said.

According to Kulkarni, China was the first country to be impacted. But it was also the first country to come out of lockdowns. So as a whole, China saw healthy economic activity for almost three-quarters of 2020. And the same thing goes for India. “When we are seeing increased deal activity and increased dollar sizes of new deals as well, I think it's a basis of the function of economic data as a whole. What are the local lockdown restrictions and what are the individual characteristics of those markets?"

Erin Peterson, a global RPO consultant with People Results, agrees with Kulkarni’s assessment.

"Things took a pause in Asia and then picked up again--quite strongly--whereas in other parts of the world we just stopped everything in terms of new deals,” she commented. “And now things are picking up again."

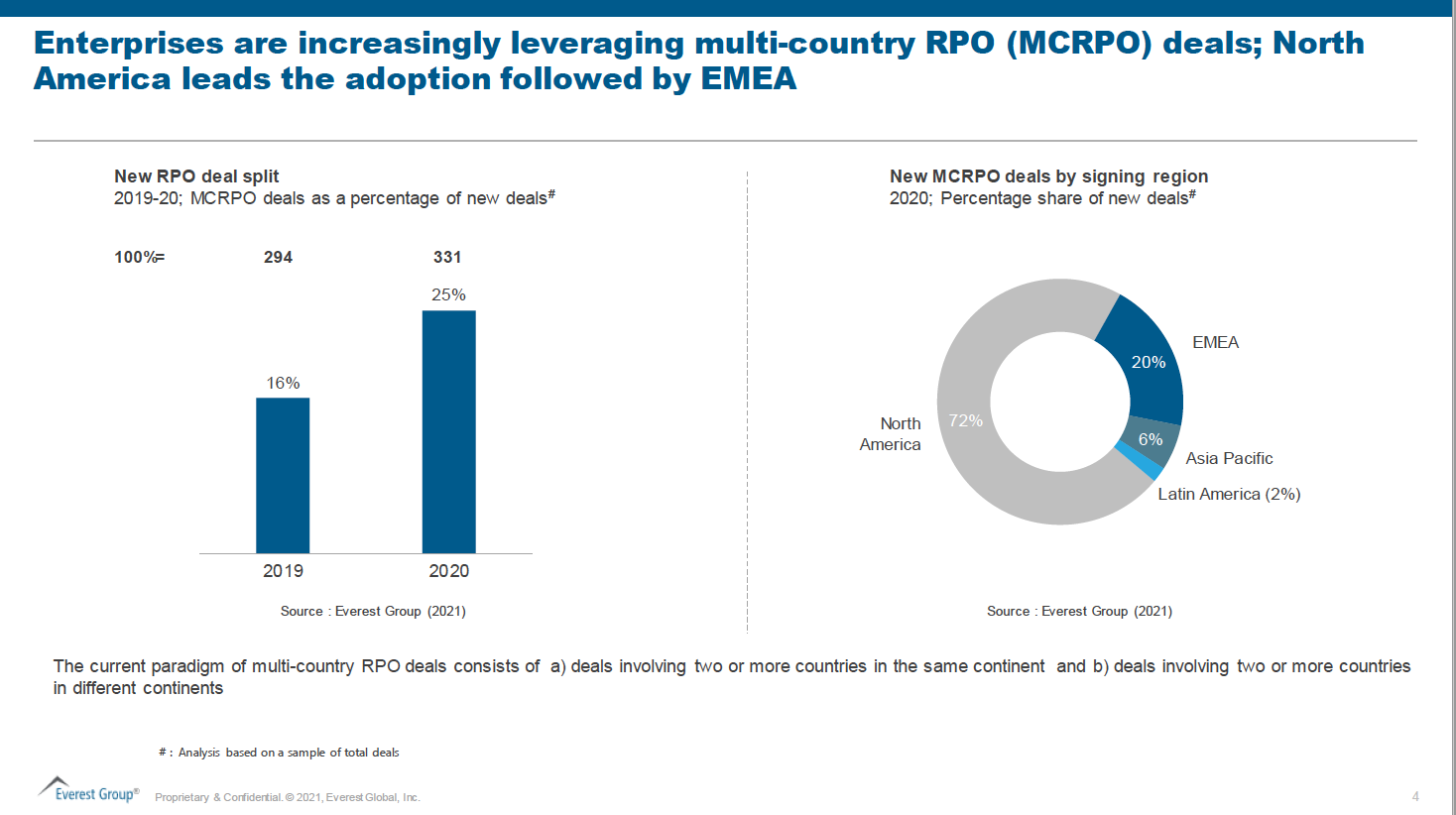

RPO deals becoming increasingly global

Everest Group defines RPO global deals as deals consisting of RPO delivery in two or more countries. Kulkarni explained that these deals could be between two countries in the same region, like a deal in the US and Canada or a deal in the UK and France. He also said that these deals could be between countries within different regions—for instance, an RPO deal between the US and the UK or the US and India.

Kulkarni emphasized that Everest has seen "among the new deals which we analyzed, the percentage of the deals that included a multi-country component has definitely gone up to about 20 to 35 percent of the deals signed in 2020.”

North American market leading in the adoption of multi-country RPO deals

Everest Group’s research analyzed the signing region of multi-country RPO deals. Meaning, "If an organization in North America signed a deal with an RPO provider, which included, let's say, an RPO deal serving both the US and Canada, then that deal considered North America as the signing region.

Everest Group found that North American organizations are leading the trend of adopting truly global multi-country RPO deals, followed closely by EMEA, and then APAC, and Latin American markets respectively. Kulkarni said that the North American region is leading in this trend because the North American region is "the powerhouse of the world economy and the majority of Fortune 500 organizations are in North America." But Kulkarni said that as the global RPO market matures, more and more organizations will search out these kinds of global deals.

A Caveat

Everest research found that in terms of the percentage of market share, these [multi-country] deals will probably stay close to 25 to 35 percent. Kulkarni explained that "we have seen increased apprehension from buyers as well in 2020. Typically these first-time buyers, let's say from the small or mid-market, want to start with a small RPO deal involving a one country RPO approach before scaling up once they have proven the success of the program." Kulkarni said that Everest isn't expecting a drastic change in the percentage of the multi-country deal, but they do expect increased adoption of global activities over the next year.

Does Everest Group look at data showing global deals consisting of clients wanting a solution in multiple regions using an RPO provider in each region?

Kulkarni clarified that Everest has only looked at data specific to only those deals where only one service provider is catering to multiple regions. "If we take the extra buyer or enterprise it will skew the data. And the share of multi-country RPO deals will be much higher because there will be organizations that have a different RPO partner in North America than the partner in EMEA, meaning multi-country RPO will be much higher than currently reported by Everest."

Peterson agreed that the number of multi-country RPO deals would be higher and pointed out that perhaps there's further research needed to talk about multiple providers for organizations. "Because once you've decided to RPO, it starts to beg the question, why not everywhere? Why only in, you know, one particular region?” Peterson said.

"Many organizations are not yet convinced that one RPO provider can serve them everywhere,” commented Peterson. “That is typically a very long conversation to get to the place where there's going to be that level of trust and risk mitigation. You know, assurance that the local laws and customers are going to be looked after by a provider who's maybe based in another part of the world,” she explained.

What keeps buyers from using one global provider for RPO?

Kulkarni said, "You [Peterson] correctly pointed out there are some concerns, especially if there are different buying centers which are involved within those organizations. So probably, each region's buying center or executives will have a different set of priorities and will have different comfort levels for different RPO providers.

Pre-pandemic, Everest saw a lot of resistance from enterprises to actually move into a truly global RPO model where one service provider is serving all the regions. One consequence of this entire exercise for the buyers, according to Kulkarni, has been that they are now closely looking at risk across the supply chain and not only in terms of the RPO but also the wider service provider relationships they have with other outsourcing providers.

“We definitely see that there is more openness to consolidate operations. There are few providers with truly global capabilities. And I think this resistance or the willingness to actually engage at a global level with a single RPO provider will increase as a result of funding. This is what we have seen across multiple conversations we've had over the years with different buyers," Kulkarni said.

What is the differentiator between an RPO leader and a star performer?

Everest's RPO PEAK Matrix has three categories: leaders, major contenders, and aspirants. The Star Performer is an award that Everest gives to service providers in any of these categories. The metrics for the award are based on what dramatic improvement that service provider has shown year over year compared to their positioning in last year's peak metrics versus this year's peak.

"I think one major thing which differentiates the Performers, which are in the top half of the peak metrics versus the bottom half of the peak metrics, is that first since it's a global peak, the global capabilities actually differentiate them a lot,” Kulkarni explained.

Secondly, what Everest has seen this year is that the more diversification or the more timely investments providers make in some of the high-growth industries (such as technology or healthcare,) the more protected they are from the impact of disruptions such as the pandemic. Providers who were concentrated in only one sector next to travel and hospitality suffered a lot. Some service providers stayed agile during the pandemic and helped clients scale up or down their operations as business needs changing.

"And last but not least, is the investments in technology, as well as the value-added services like consulting advisory on diversity and inclusion. I think those are the value-adds after the table stakes when venting all of the service providers that really differentiate the players who perform really well on the Peak Metrics and those who are moving there but still some time off from that."

The RPOA hopes this discussion has filled you with hope and optimism for the future of the global RPO market. Please join this discussion and others like it to feel the pulse of RPO markets worldwide and in your neighborhood.